Being in college is expensive — tuition, books, and rent already take a big bite out of your budget. So when it comes to car insurance, students are looking for one thing: affordability without sacrificing coverage.

The good news? Even if you’re under 25 and considered “high risk,” there are smart ways to find cheap car insurance that still protects you on and off campus. In this 2025 guide, we break down the best affordable insurance options for college students and how to maximize your savings.

Why Is Car Insurance Expensive for College Students?

Car insurance is all about risk — and statistically, young drivers under 25 (especially males) file more claims. That means higher rates, even for students with clean driving records. But age isn’t the only factor.

- Limited driving experience

- Higher accident rates

- Often drive older cars with less safety tech

- May have no prior insurance history

The key is to work with insurers who understand student needs — and reward safe behavior and smart choices.

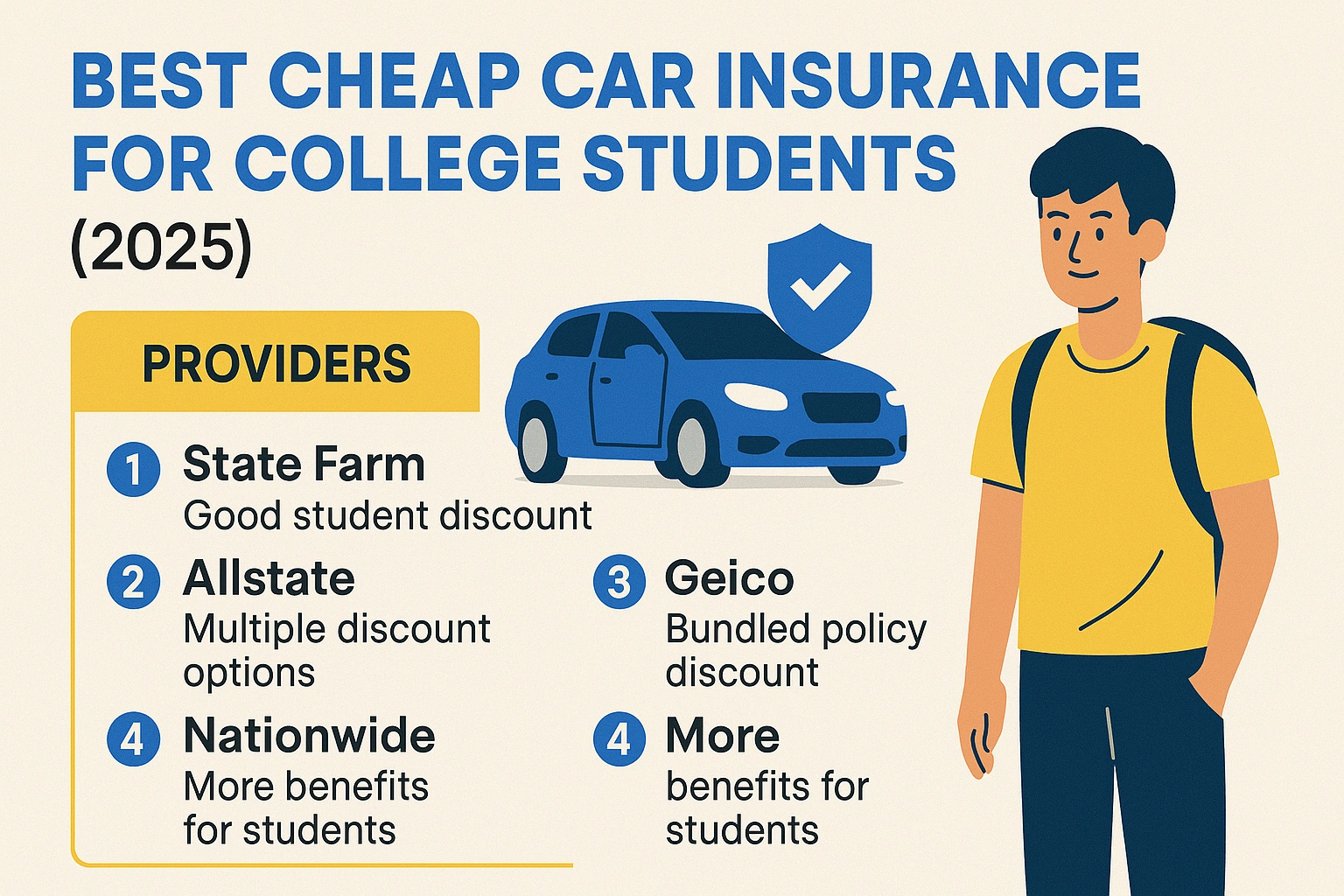

Top 5 Cheap Car Insurance Providers for College Students (2025)

1. GEICO

Known for low rates and student-friendly discounts like:

- Good student discount (B average or higher)

- Membership and organization savings

- Mobile app for easy claims and policy management

2. State Farm

Offers the Steer Clear® Program for drivers under 25, which can save up to 15% for safe driving and completing mini-courses online.

3. Progressive

Great for tech-savvy students. Progressive’s Snapshot® usage-based app rewards good driving and offers personalized rates — often with huge discounts for low-mileage users.

4. Nationwide

Offers the SmartRide® program for up to 40% off based on driving habits, plus accident forgiveness and bundling discounts with renters insurance — perfect for dorm life.

5. Erie Insurance (Available in select states)

Highly rated for customer service and low complaint rates. Offers first-time driver support, college-based discounts, and lower-than-average premiums for young adults.

Ways College Students Can Save on Car Insurance

- Good Student Discount: GPA 3.0 or higher? Save 10–25%

- Stay on a Parent’s Policy: Often cheaper than going solo

- Drive Less: Use a UBI program for low-mileage savings

- Skip Collision on Old Cars: If your car’s worth less than $3K

- Bundle Policies: Combine with renters or health insurance

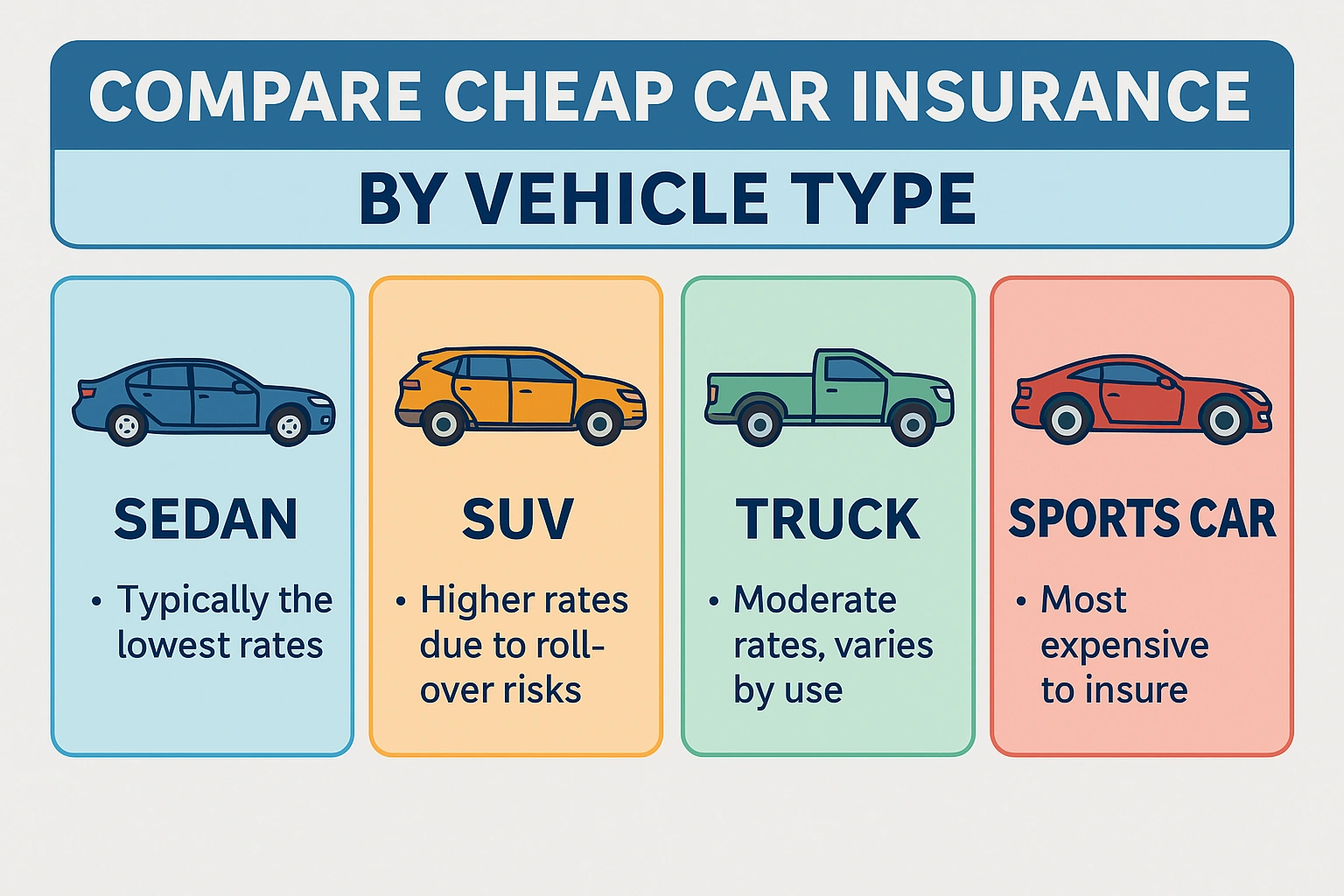

- Choose a Safe Vehicle: Older sedans = lower rates

- Use Telematics: Let your driving habits lower your rate

What Coverage Do College Students Really Need?

While state minimum liability is the cheapest, it may not be enough. Consider:

- Liability coverage: Required in every state

- Collision & comprehensive: Recommended for newer or financed cars

- Uninsured motorist coverage: Critical in states with high uninsured driver rates

If you live in a dorm and don’t drive much, ask about “student away at school” discounts or part-time driver policies.

Final Thoughts

Cheap car insurance for college students does exist — but you have to know where to look. By choosing the right provider, stacking discounts, and tailoring your coverage to your needs, you can stay protected on a student budget.

Start by comparing real quotes and ask each insurer what they offer for students. The more you know, the less you’ll pay.