Auto insurance is one of those unavoidable expenses — but what if you could lower your quote in just minutes? The truth is, most drivers overpay without even realizing it. Fortunately, there are smart, fast ways to reduce your premium — without sacrificing coverage.

Whether you’re switching providers or getting your first quote, these 5 insurance hacks can instantly save you money in 2025.

1. Adjust Your Deductibles

Raising your deductible — the amount you pay before insurance kicks in — is one of the fastest ways to lower your monthly rate. For example, bumping your deductible from $500 to $1,000 can lower your premium by 10–20%.

💡 Tip: Only do this if you have enough savings to cover the higher deductible in an emergency.

2. Remove Unnecessary Coverage

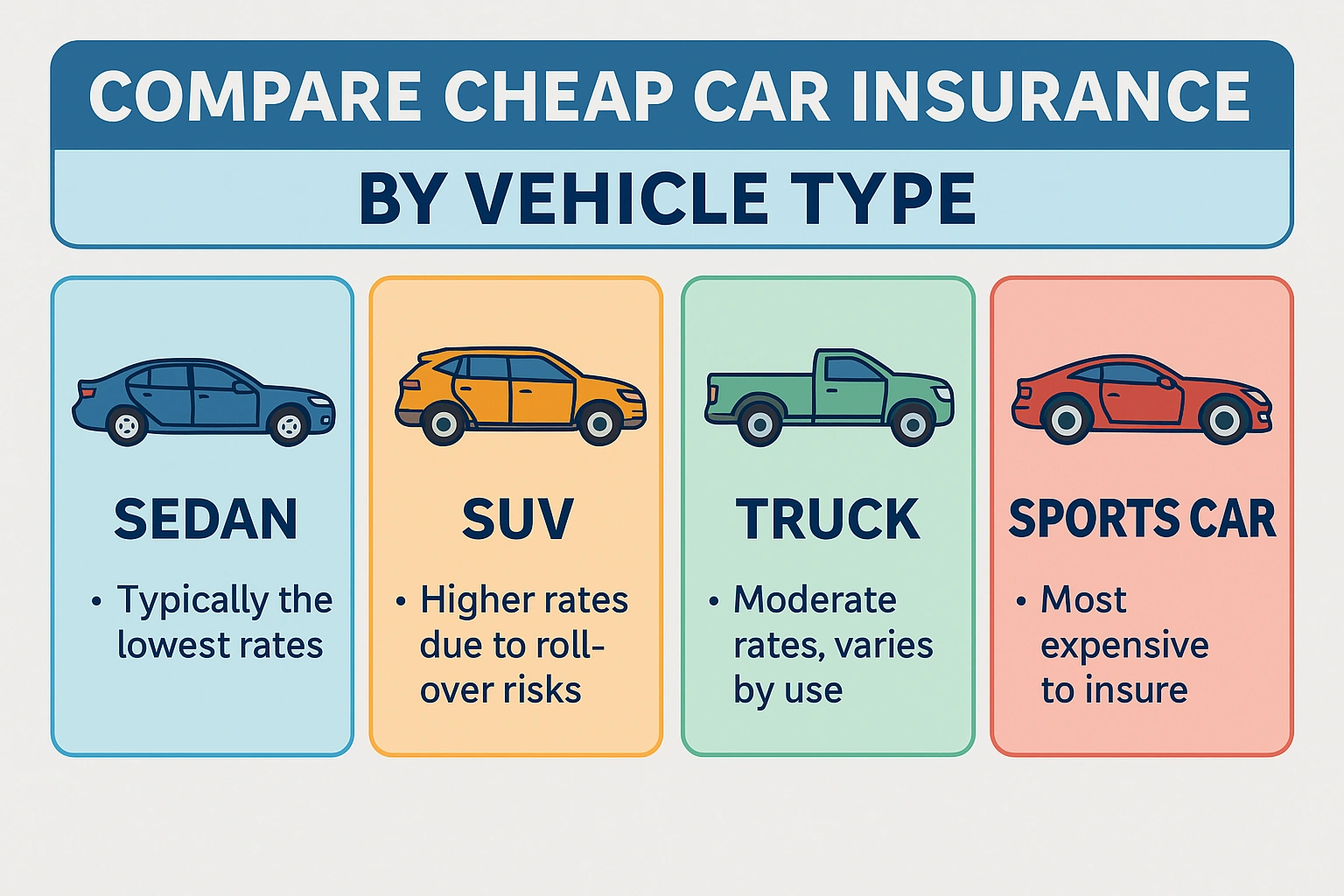

Still paying for roadside assistance or rental car coverage? If you already have AAA or don’t rent cars often, removing these add-ons can trim your bill. Also, consider dropping collision/comprehensive coverage if your car is worth less than $3,000.

💡 Tip: Use Kelley Blue Book or Edmunds to check your vehicle’s current value.

3. Use a Telematics Program

Insurers love data. Sign up for a usage-based program like Snapshot® (Progressive), Drivewise® (Allstate), or SmartRide® (Nationwide) and let your driving habits speak for themselves. Safe drivers can save up to 30%.

💡 Tip: These programs are perfect for low-mileage drivers and cautious commuters.

4. Bundle Your Policies

Most insurers offer a generous discount when you combine auto insurance with another product — like homeowners, renters, or life insurance. This can slash your premium by 10–25%.

💡 Tip: Even bundling auto + renters (as low as $10/month) qualifies you for the discount.

5. Shop Around Every 6 Months

Loyalty doesn’t always pay. Rates can change due to your ZIP code, vehicle age, driving history, or even updated company algorithms. Compare quotes from at least 3–5 providers twice a year — you might find a better deal in minutes.

💡 Tip: Use trusted tools like The Zebra, NerdWallet, or Compare.com to check live rates.

Final Thoughts

You don’t need to sacrifice quality coverage to pay less for car insurance. By adjusting a few key details and shopping smart, you can lower your quote instantly — and keep those savings coming year after year.

Try one (or all) of these hacks today, and watch your premium drop faster than you thought possible.